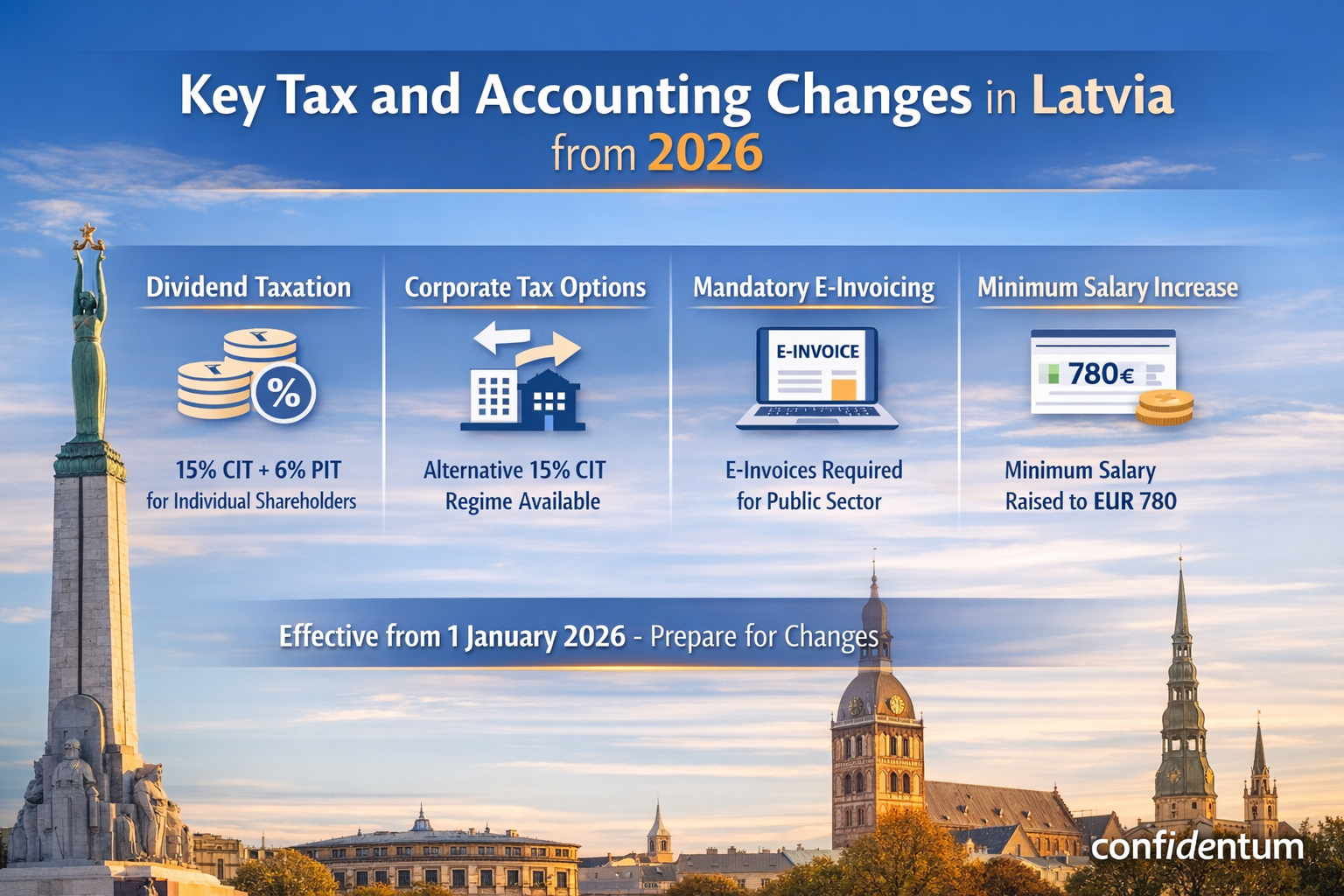

From 1 January 2026, several important tax and compliance changes will come into force in Latvia.

Dividend taxation

Companies whose shareholders are only individuals will be able to opt for an alternative 15% corporate income tax on distributed profits. Dividends paid under this regime will be subject to an additional 6% personal income tax at the shareholder level. The alternative 15% CIT regime will exist alongside the current Latvian CIT system, allowing owner-managed companies to choose the structure that best fits their business and tax planning.

Mandatory e-invoicing

From January 2026, e-invoices will be mandatory for all invoices issued to Latvian state and municipal institutions. E-invoice data must also be submitted to the State Revenue Service (VID).

Minimum salary increase

The minimum gross monthly salary will increase to EUR 780, impacting payroll costs and employment arrangements.

These changes affect tax planning, accounting systems, and payroll compliance. Early preparation is recommended to ensure a smooth transition.