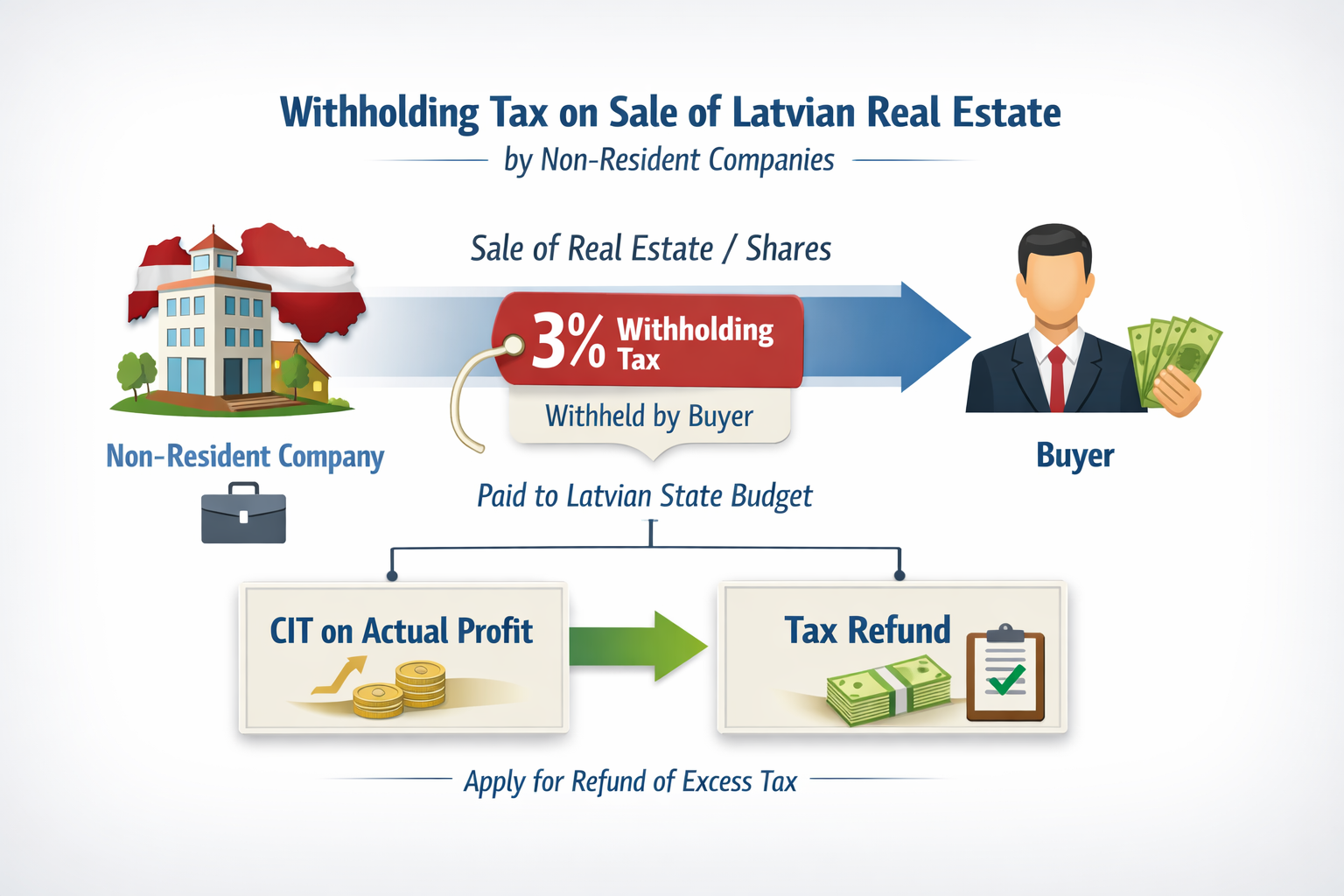

When a non-resident company sells real estate located in Latvia, or a daughter company whose assets mainly consists of the real estate, Latvian tax law requires a 3% withholding tax.

What is the 3% tax?

The 3% is Corporate Income Tax (CIT).

It applies only to non-resident legal entities (companies) — not to natural persons.

Who withholds the tax?

In the case of a share sale, the buyer must withhold 3% of the transaction value and pay it to the Latvian state budget, in accordance with the Corporate Income Tax Law. The withholding is applied to the gross transaction value, regardless of whether the seller ultimately makes a profit or a loss.

What if the buyer has no withholding obligation?

If the buyer is a natural person or another non-resident who is not required to withhold tax in Latvia, the withholding mechanism does not apply. In this case, the non-resident company selling the asset has a choice how to be taxed in Latvia.

The seller may choose between:

- 3% Corporate Income Tax on the gross transaction value: The non-resident company declares and pays 3% CIT on the full sale price. This is the simplest option and does not require profit calculations.

- Corporate Income Tax on actual profit: The non-resident company may apply to be taxed on the actual profit from the transaction (sale price less acquisition and related costs). This option requires proper documentation and tax filings in Latvia but may result in a lower tax burden.

This choice is available only when the buyer has no obligation to withhold the 3% tax. If the buyer is a Latvian company or another obligated withholding agent, the 3% must be withheld at source.

Can the 3% be refunded?

Yes, if the seller is EU entity or there is tax treaty. A non-resident company may apply to be taxed on the actual profit from the transaction. If the CIT calculated on the profit is lower than the withheld 3%, the difference — or even the full amount — may be refunded by the Latvian tax authorities.